Understanding the Factors Influencing Cryptocurrency Prices

Decoding the Factors Influencing Cryptocurrency Prices: A Comprehensive Analysis

Introduction to Cryptocurrency Prices

Decoding the Factors Influencing Cryptocurrency Prices: A Comprehensive Analysis | Cryptocurrencies have become a significant force in the global financial landscape, revolutionizing the way we perceive and interact with money. One crucial aspect of cryptocurrencies is their fluctuating prices, which can rise and fall dramatically within short periods. Understanding the factors that influence cryptocurrency prices is essential for anyone seeking to navigate this dynamic market successfully. In this comprehensive analysis, we will delve into the various components that shape cryptocurrency prices and explore their intricacies.

Understanding the Basics of Cryptocurrencies

Before diving into the Factors Influencing Cryptocurrency Prices, it is crucial to have a solid understanding of the underlying technology and principles driving these digital assets. Cryptocurrencies are decentralised digital currencies that utilise cryptography for secure transactions and control the creation of new units. They operate on blockchain technology, a distributed ledger that records all transactions in a transparent and immutable manner.

Significance of Price Analysis in Cryptocurrency Market

Price analysis plays a vital role in the cryptocurrency market as it helps investors, traders, and enthusiasts make informed decisions. By examining price trends, patterns, and indicators, market participants can identify potential buying or selling opportunities, manage risk, and gauge market sentiment. Cryptocurrency prices are influenced by a multitude of factors, both internal and external, that we will explore in detail.

Exploring Market Volatility in the Crypto Space

One prominent characteristic of the cryptocurrency market is its inherent volatility. Prices can experience rapid and substantial fluctuations, creating both opportunities and risks for investors. This volatility is driven by several factors, including market sentiment, regulatory developments, technological advancements, and macroeconomic events. Understanding and navigating this volatility is crucial for participants in the cryptocurrency space.

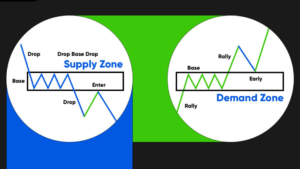

Supply and Demand Dynamics

Cryptocurrency prices are heavily influenced by the fundamental principles of supply and demand. Several factors contribute to the intricate supply and demand dynamics in the crypto market, as outlined below.

Evaluating the Role of Scarcity in Cryptocurrency Prices

Scarcity is a foundational principle that impacts the value of cryptocurrencies. Some cryptocurrencies have a limited supply, meaning there is a cap on the total number of coins that can ever be created. Bitcoin, for example, has a maximum supply of 21 million coins. This limited supply creates scarcity, driving up the price as demand increases.

Token Supply and Coin Halving Events

Another aspect that affects cryptocurrency prices is the token supply and periodic events like coin halving. Coin halving is a process embedded in the code of certain cryptocurrencies, wherein the number of new coins issued to miners for validating transactions is reduced by half after a predetermined number of blocks. This reduction in supply has historically resulted in increased prices as the scarcity of new coins intensifies.

Mining Difficulty and Reward Structures

Mining difficulty refers to the computational effort required to validate transactions and add new blocks to the blockchain. As mining difficulty increases, it becomes more challenging and resource-intensive to mine new coins. The complexity of the mining process impacts the supply of new coins, thereby influencing their prices. Reward structures, such as block rewards and transaction fees, also play a role in incentivizing miners and affecting the overall supply and demand dynamics.

Token Burning and Inflationary Mechanisms

Token burning is a practice in which a portion of existing tokens is intentionally destroyed or removed from circulation. This process reduces the token supply, creating scarcity and potentially driving up prices. Conversely, inflationary mechanisms, such as the creation of new tokens through decentralised governance models, can have the opposite effect, increasing the supply and potentially exerting downward pressure on prices.

The Influence of Investor Demand on Cryptocurrency Prices

Investor demand is a crucial factor in determining the prices of cryptocurrencies. Market sentiment, investor confidence, and perception of future value all contribute to demand. Positive news, partnerships, and technological advancements surrounding a particular cryptocurrency can attract investors, driving up demand and subsequently impacting prices. On the other hand, negative sentiments or regulatory crackdowns can lead to a decrease in demand and a subsequent decline in prices.

Market Liquidity and Order Books

Market liquidity refers to the ease with which a cryptocurrency can be bought or sold without significantly affecting its price. Highly liquid markets tend to have a large number of buyers and sellers, creating a balanced supply-demand relationship. Thinly traded markets, on the other hand, may experience more significant price swings due to the limited number of participants. Order books, which reflect the current buy and sell orders at different price levels, provide insights into market liquidity and can influence prices as orders are executed.

Trading Volumes and Exchange Activities

Trading volumes, representing the total amount of a cryptocurrency being bought and sold within a specific period, also impact prices. Higher trading volumes often indicate increased market activity and can contribute to price volatility. Exchange activities, such as the listing of new cryptocurrencies, trading competitions, or the introduction of innovative trading features, can further influence trading volumes and subsequently impact prices.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation play a significant role in shaping cryptocurrency prices. Market participants’ emotions, such as fear, greed, and optimism, can drive buying or selling pressure. Speculative trading, driven by expectations of future price movements, can result in exaggerated price swings. Understanding investor sentiment and market speculation is crucial for making informed decisions in the cryptocurrency market.

Technological Advancements and Innovations

Technological advancements and innovations have a profound influence on cryptocurrency prices. The rapid evolution of blockchain technology and its various applications introduces new dynamics into the market. Let’s explore the key technological factors that shape cryptocurrency prices.

Examining the Impact of Blockchain Technology

Blockchain technology forms the foundation of cryptocurrencies and has wide-ranging implications for various industries. Its decentralized, transparent, and secure nature enables new possibilities and use cases. The adoption and development of blockchain technology impact the value and utility of cryptocurrencies. For instance, an increase in the number of companies or governments adopting blockchain can spur demand for associated cryptocurrencies, leading to increased prices.

Scalability and Transaction Speed

Scalability refers to a blockchain’s ability to handle an increasing number of transactions without compromising its performance. The scalability of a cryptocurrency impacts its usability and adoption rate. Cryptocurrencies with high scalability, capable of processing a high volume of transactions quickly and at low costs, are more likely to attract demand and witness price appreciation.

Security and Privacy Features

Security and privacy features are crucial considerations for cryptocurrency users and investors. Blockchain technology offers enhanced security and privacy through encryption and decentralized consensus mechanisms. Cryptocurrencies with robust security measures are more likely to be trusted and widely adopted. The integration of additional privacy features, such as zero-knowledge proofs or advanced cryptography, can also affect prices as they enhance user anonymity and protect sensitive information.

Interoperability and Cross-Chain Solutions

Interoperability refers to the ability of different blockchain networks to communicate and share information with each other seamlessly. Cross-chain solutions enable the transfer of assets across multiple blockchains, eliminating the need for intermediaries. Interoperability and cross-chain functionalities enhance the utility and versatility of cryptocurrencies, potentially contributing to increased demand and price appreciation.

Unraveling the Role of Smart Contracts and Decentralized Finance (DeFi)

Smart contracts are self-executing agreements coded onto the blockchain that automatically execute predefined actions when specific conditions are met. They enable the creation of decentralized applications (DApps) and facilitate complex financial transactions. The growth of decentralized finance (DeFi) applications, which leverage smart contracts to offer financial services without intermediaries, has led to increased demand for cryptocurrencies powering these platforms. Smart contract capabilities and advancements in DeFi continue to impact cryptocurrency prices.

Decentralized Exchanges (DEXs) and Liquidity Pools

Decentralized exchanges (DEXs) operate on blockchain technology, allowing users to trade cryptocurrencies directly without the need for intermediaries. DEXs offer increased security, transparency, and control over funds. The rise of DEXs and liquidity pools, where users can provide liquidity and earn rewards, has altered the traditional exchange landscape. The growing popularity of DEXs affects the demand for cryptocurrencies used within these platforms, potentially causing price fluctuations.

Yield Farming and Staking Opportunities

Yield farming and staking are strategies used by cryptocurrency holders to generate additional income. Yield farming involves providing liquidity to DeFi protocols and earning rewards in the form of additional tokens. Staking involves locking up cryptocurrencies to participate in the consensus mechanism of blockchain networks and earning staking rewards. Yield farming and staking opportunities can attract investors and contribute to price movements.

Token Utility and Governance Models

The utility of a cryptocurrency, or its practical use in real-world applications, influences its value and market demand. Cryptocurrencies with a wide range of applications, such as being used for payments, access to services, or voting rights in decentralized governance models, are more likely to experience increased demand and price appreciation. Governance models, wherein token holders participate in decision-making processes for protocol upgrades or network changes, also impact the value of cryptocurrencies.

Regulatory Environment and Legal Considerations

Government regulations and legal considerations significantly influence the cryptocurrency market. As cryptocurrencies continue to gain traction, governments worldwide are establishing regulatory frameworks to address issues such as consumer protection, money laundering, and financial stability. Understanding the regulatory landscape is crucial for evaluating the impact on cryptocurrency prices.

Demystifying the Impact of Government Regulations

Government regulations can have both positive and negative effects on cryptocurrency prices. Clarity and supportive regulations can provide confidence and attract institutional investors, potentially driving up demand and prices. On the other hand, excessive regulations or unfavorable policies can suppress demand and cause price declines. Monitoring regulatory developments and understanding their implications is essential for assessing the risk and potential movements in cryptocurrency prices.

Regulatory Approaches Across Different Countries

Regulatory approaches towards cryptocurrencies vary across countries. Some jurisdictions have embraced cryptocurrencies and provided a conducive environment for their growth, while others have taken a more cautious or restrictive approach. Understanding the regulatory stance of different countries and their impact on cryptocurrency prices is crucial for investors and market participants.

AML and KYC Compliance Measures

Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance measures are essential for cryptocurrencies to gain credibility and mainstream adoption. These measures aim to prevent illicit activities, such as money laundering and terrorist financing. Cryptocurrencies that implement robust AML and KYC procedures are more likely to be compliant with regulations, increasing investor trust and potentially contributing to price stability.

Impact of Securities Laws on Token Offerings

Securities laws play a significant role in shaping the regulatory environment for token offerings, such as initial coin offerings (ICOs) or security token offerings (STOs). The classification of a cryptocurrency token as a security can subject it to additional regulatory requirements, affecting its liquidity, trading, and overall value. Understanding the legal implications and compliance requirements for token offerings is essential for assessing the potential impact on cryptocurrency prices.

Taxation and Reporting Obligations

Taxation policies and reporting obligations differ from country to country and can impact the profitability and attractiveness of cryptocurrency investments. Cryptocurrency holders may be subject to capital gains tax, income tax, or other tax obligations. Changes in taxation policies or reporting requirements can influence investor behavior and potentially affect cryptocurrency prices.

Cryptocurrency Classification for Taxation Purposes

The classification of cryptocurrencies for taxation purposes varies across jurisdictions. Some countries treat them as property, while others classify them as commodities, securities, or currency. The classification of cryptocurrencies can have significant implications for tax obligations and reporting requirements. Understanding the tax treatment of cryptocurrencies is essential for investors and can impact their buying, selling, or holding decisions, consequently influencing prices.

Tax Reporting and Capital Gains

Tax reporting obligations for cryptocurrency investments generally include reporting capital gains or losses, tracking cost basis, and complying with reporting deadlines. Decisions regarding tax reporting and capital gains can impact investor behavior and potentially affect cryptocurrency prices. Changes in tax regulations or increased scrutiny can lead to price fluctuations as investors adjust their positions to comply with tax obligations.

International Tax Considerations

Cryptocurrency investments and transactions often transcend national boundaries, leading to complex international tax considerations. Tax implications can vary depending on the jurisdiction of the investor, location of the cryptocurrency exchange, and nature of the transaction. Understanding international tax obligations and avoiding potential pitfalls is essential for investors and can influence cryptocurrency prices.

Macro-Economic Factors and Global Events

Cryptocurrency prices are not insulated from macro-economic forces and global events. Economic indicators, inflation rates, geopolitical events, and the integration of cryptocurrencies into traditional financial systems all have an impact on cryptocurrency prices. Let’s explore these factors in detail.

Analyzing the Influence of Economic Indicators

Economic indicators, such as GDP growth, employment rates, inflation, and interest rates, impact investor sentiment and overall market conditions. Positive economic indicators can instill confidence and attract investment, potentially driving up cryptocurrency prices. Conversely, negative economic indicators can lead to a flight to safe havens and a decrease in demand for cryptocurrencies, exerting downward pressure on prices.

Inflation Rates and Monetary Policies

Inflation rates and monetary policies play a significant role in shaping the value of cryptocurrencies. Cryptocurrencies often serve as alternatives to traditional fiat currencies, which can be subject to inflationary pressures. Countries with high inflation rates or unstable monetary policies may witness increased adoption of cryptocurrencies as a store of value, leading to higher prices in those markets.

Global Economic Uncertainty and Flight to Safe Havens

Global economic uncertainty, such as geopolitical conflicts, trade wars, or financial crises, can trigger a flight to safe havens. Cryptocurrencies, particularly those perceived as safe store of value assets like Bitcoin, can benefit from increased demand during times of economic instability. Understanding the correlation between global events and cryptocurrency prices is essential for investors seeking to diversify their portfolios.

Geopolitical Events and Their Implications

Geopolitical events can have a profound impact on cryptocurrency prices. Factors such as regulatory actions, government endorsements, or bans and restrictions imposed by specific countries can significantly influence investor sentiment and demand for cryptocurrencies. Monitoring geopolitical developments and their potential impact on cryptocurrency prices is crucial for market participants.

Integration of Cryptocurrencies in Traditional Financial Systems

The integration of cryptocurrencies into traditional financial systems has the potential to shape their prices. Increased acceptance and adoption by financial institutions, payment processors, or online merchants can enhance the utility and mainstream appeal of cryptocurrencies. As the technology bridges the gap between traditional finance and the crypto space, it can influence prices by attracting new users and expanding the user base.

Institutional Adoption and Investment Products

Institutional adoption of cryptocurrencies has gained significant momentum in recent years. The entry of institutional players, such as hedge funds, asset managers, or pension funds, can bring increased liquidity and stability to the cryptocurrency market. Institutional adoption often signals maturity and legitimacy, potentially attracting more investors and contributing to price appreciation.

Central Bank Digital Currencies (CBDCs) and Cross-Border Payments

The development and adoption of central bank digital currencies (CBDCs) have garnered attention worldwide. CBDCs, backed by central banks, have the potential to revolutionize traditional currencies and payment systems. The introduction of CBDCs can impact cryptocurrency prices by posing competition or providing validation to existing cryptocurrencies.

Adoption of Cryptocurrencies in Emerging Markets

Cryptocurrency adoption in emerging markets has the potential to influence prices significantly. Factors such as economic instability, limited access to traditional banking systems, or high remittance costs make cryptocurrencies.

These are all Factors Influencing Cryptocurrency Prices. All the buyers and sellers watch these Factors Influencing Cryptocurrency Prices deeply and update himself. You can update your self to watch daily crypto trend tales website and get update yourself.

Absolutely fascinating insights on cryptocurrency prices! It’s incredible to see how various factors shape the market dynamics. Keep the positive vibes flowing and share your thoughts on the forces driving crypto prices

Absolutely fascinating insights on cryptocurrency prices! It’s incredible to see how various factors shape the market dynamics. Keep the positive vibes flowing and share your thoughts on the forces driving crypto prices